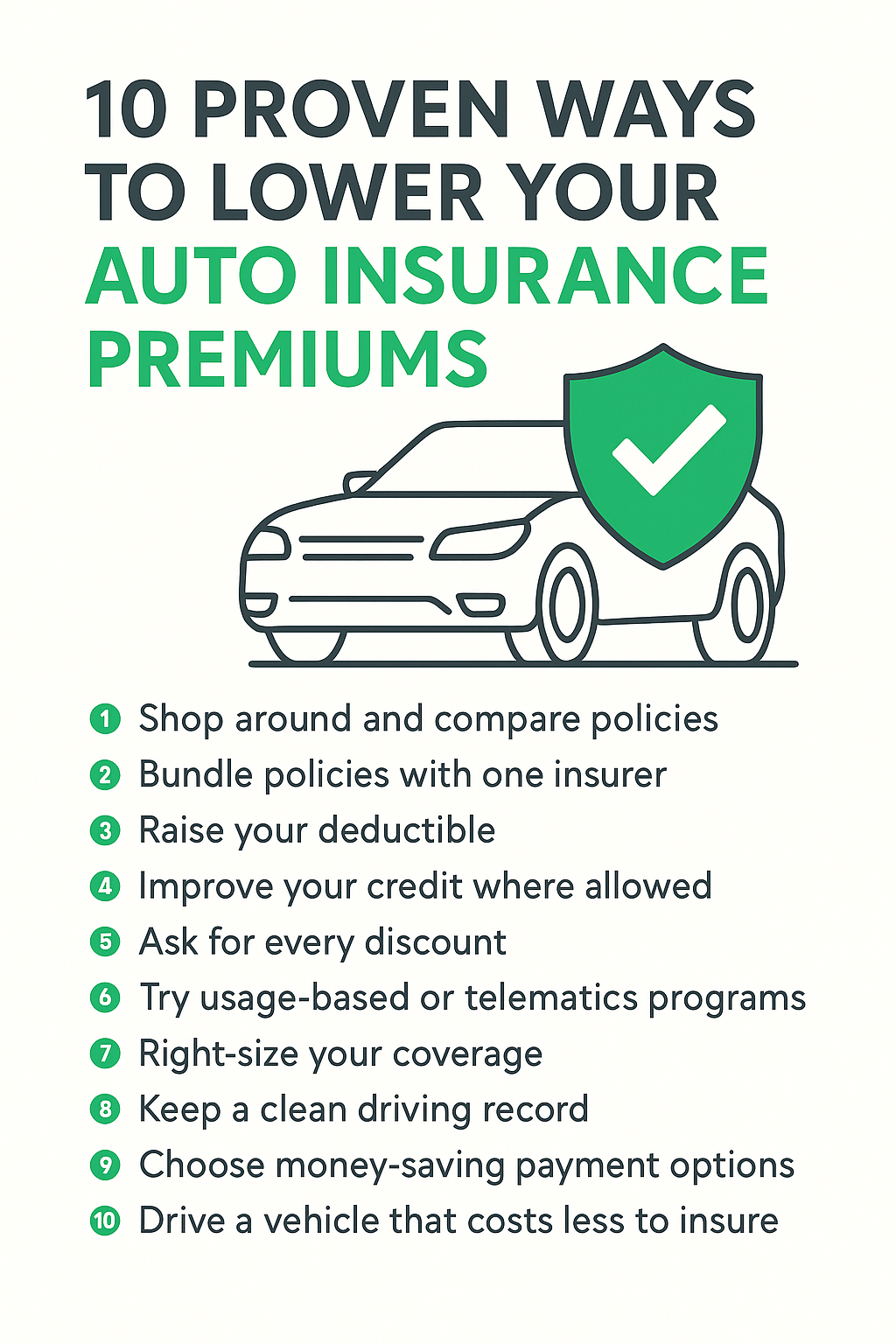

10 Proven Ways to Lower Your Auto Insurance Premiums

Auto insurance is essential, but it does not have to be expensive. Use these practical strategies to reduce your premium while keeping the protection you need.

1. Shop around and compare policies

Prices vary widely by company. Get quotes from several insurers and compare the same coverage limits and deductibles. Recheck before every renewal.

2. Bundle policies with one insurer

Combining auto with home, renters, or other coverage can unlock a multi policy discount and simplify billing.

3. Raise your deductible

A higher deductible usually lowers your premium. Choose an amount you can comfortably cover from savings in the event of a claim.

4. Improve your credit where allowed

In many states, insurers consider credit based insurance scores. Pay bills on time, keep balances low, and avoid unnecessary new accounts.

5. Ask for every discount

Common discounts include safe driver, low mileage, good student, defensive driving course, employer or alumni group, and safety features like anti lock brakes and air bags. Ask your agent to review eligibility each year.

6. Try usage based or telematics programs

Opt in to a program that tracks driving habits such as braking, acceleration, and time of day. Safe habits can earn additional savings.

7. Right size your coverage

Match liability limits to your assets and risk tolerance. For older vehicles with low market value, consider whether collision or comprehensive still makes sense. Do not cut essential protection just to save a little.

8. Keep a clean driving record

Avoid tickets and accidents by driving defensively. Small incidents add up. If available, consider accident forgiveness to protect your rate after a first at fault claim.

9. Choose money saving payment options

Pay in full if you can, or set up automatic payments and paperless billing. Many insurers offer lower installment fees or discounts for these choices.

10. Drive a vehicle that costs less to insure

Before you buy, check insurance costs for that make and model. Vehicles with strong safety ratings, lower repair costs, and strong theft prevention often carry lower premiums.

Quick action checklist

- Collect three or more comparable quotes

- Ask your current insurer to apply all discounts

- Review limits and deductibles and adjust if appropriate

- Enroll in a telematics program if you drive safely

- Set reminders to review your policy every six months

Note Insurance rules vary by state. Confirm eligibility and program availability with your insurer or licensed agent.